Introduction

Hey, dear readers. Remember SHIB that drove everyone crazy in 2021? At that time, the entire crypto world was discussing this topic, and my social media feeds were flooded with SHIB content. It was being talked about on Weibo and various social media platforms, and even my roommate, who usually had zero interest in investments, came to ask me if we should buy some. SHIB's growth was simply jaw-dropping, increasing by tens of thousands of times in just a few months. This crazy scene made me wonder: why were so many people rushing to buy a Dogecoin knockoff?

I remember I was writing my thesis at the time, but I still couldn't help spending an entire weekend researching SHIB's whitepaper and community discussions. This process sparked my deep interest in cryptocurrencies and got me thinking about the future development of digital assets. Today, let me share with you my understanding of cryptocurrencies in the simplest terms.

Understanding Cryptocurrency

When it comes to cryptocurrency, many people's first reaction might be: isn't it just for speculation? Indeed, speculation is one characteristic of the cryptocurrency market, but that's not all there is to it. Have you ever wondered why we need cryptocurrency?

Let me start with a real-life scenario. Last year, I bought a limited edition pair of sneakers from an e-commerce platform, which cost me nearly ten thousand yuan. Because it was a limited edition, I could only buy it from overseas. During the payment process, I had to pay high cross-border transaction fees, and it took a whole week for the transaction to be confirmed. This frustrated me - why is cross-border payment still so complicated in the internet age?

Cryptocurrency is like "digital gold" for the internet age, and it completely changes this situation. It doesn't need banks or intermediaries to achieve rapid value transfer. Traditional bank cross-border transfers not only have high fees but also require 3-5 business days. But with cryptocurrency, it can be done in just minutes, with very low fees.

My first experience using cryptocurrency for transfer left a deep impression. It was in 2020 when I needed to transfer tuition fees to a friend studying in Australia. I chose to transfer 0.1 ETH. The whole process was incredibly smooth: open wallet, enter address, confirm transfer, then just wait for block confirmation. From clicking send to receipt, it took less than 2 minutes, with only a few dollars in fees. With traditional bank transfers, the fees alone would be dozens of dollars, plus filling out complex forms and waiting for several days.

This experience helped me deeply understand the value of cryptocurrency. It's not just an investment vehicle, but a revolutionary payment tool. Imagine, in the near future, we might be able to use cryptocurrency to pay for everything in daily life: buying coffee, booking flights, paying rent, all completed in seconds with negligible fees.

Another important feature of cryptocurrency is its decentralized nature. In traditional financial systems, our funds need to be managed through centralized institutions like banks. But in the cryptocurrency world, you are the true owner of your assets. No one can freeze your account, no one can restrict your transactions, and you can trade at any time, anywhere.

Of course, this freedom also means greater responsibility. In the cryptocurrency world, once you lose your private key (like your bank card PIN), your assets are truly unrecoverable. So I suggest newcomers must learn about wallet usage and asset security knowledge before entering the market.

Technical Principles

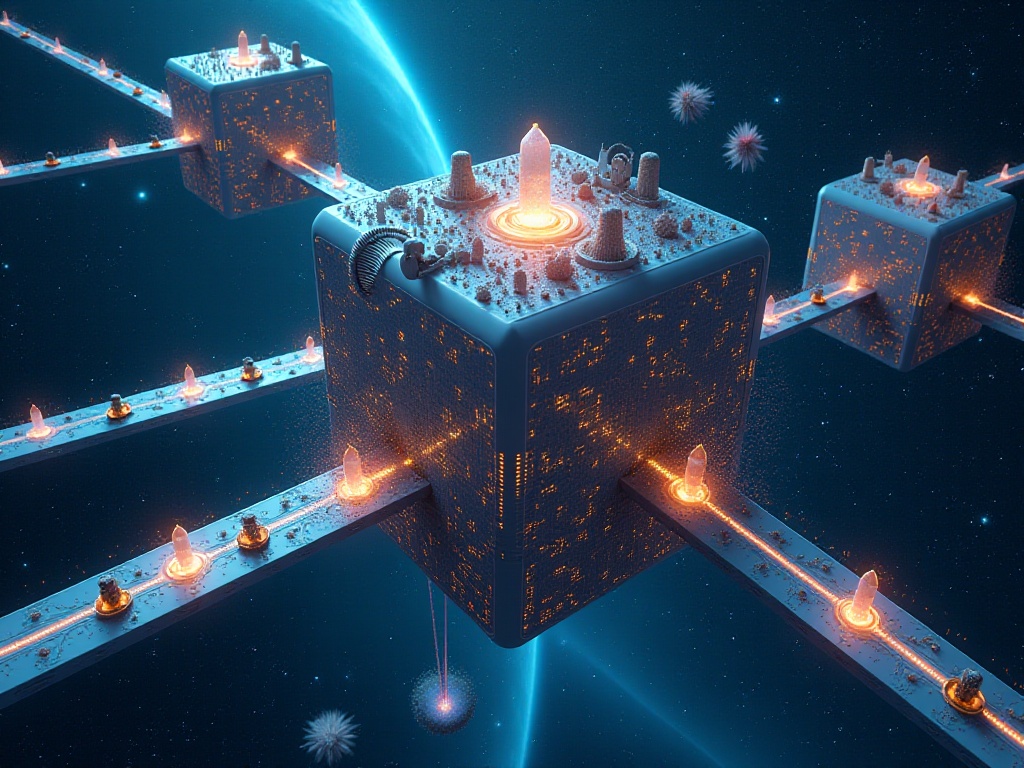

When it comes to the technical principles of cryptocurrency, many people get overwhelmed. Indeed, terms like blockchain technology, cryptography, and consensus mechanisms sound very technical. But if we explain them simply, they're not that hard to understand.

Imagine cryptocurrency as a transparent, never-closing global ledger. This ledger has several characteristics: first, it's public, everyone can view it; second, it's immutable, once recorded it exists forever; finally, it's decentralized, requiring no centralized institutions like banks to maintain it.

This system mainly operates through two methods: "Proof of Work" (PoW) and "Proof of Stake" (PoS). Let me explain these two mechanisms with a simple analogy.

Proof of Work is like a math problem competition. Miners (those who maintain the system) need to solve complex math problems, and whoever solves it first gets the right to record transactions and receive rewards. It's like in a classroom where the teacher gives a very difficult math problem, and whoever solves it first gets a reward. But this method has a problem - it consumes too much electricity. It's like having the whole class frantically solving problems, but only one person gets the reward, while everyone else's efforts are wasted.

Proof of Stake is more like a shareholder voting system. In this system, the more tokens you hold, the more likely you are to get the right to record transactions. It's like a company's shareholders' meeting, where those with more shares have a bigger say. This method is more environmentally friendly and efficient.

Ethereum switched from Proof of Work to Proof of Stake in 2022, known as "The Merge." This upgrade greatly reduced Ethereum's energy consumption, reportedly by 99.95%. This made Ethereum more environmentally friendly and prepared it for future scaling.

On the technical level, cryptocurrency involves many interesting concepts. For example, smart contracts are like automatically executing programs that ensure transactions follow preset rules. Zero-knowledge proofs can prove conditions are met without revealing specific information. These technologies may seem complex, but they all aim to make the system more secure, efficient, and decentralized.

Innovative Applications

The cryptocurrency ecosystem continues to evolve with remarkable creativity. Beyond financial transactions, blockchain technology is enabling novel applications across various industries. Gaming platforms now integrate crypto assets as in-game currencies, while digital artists use NFTs to authenticate ownership of virtual creations. Some decentralized autonomous organizations (DAOs) are experimenting with community-driven governance models where token holders collectively make decisions.

Particularly noteworthy are the emerging play-to-earn models that blend entertainment with economic incentives. These platforms allow users to accumulate tangible rewards through gameplay while maintaining true ownership of their digital assets. Such innovations demonstrate blockchain's potential to redefine user engagement in digital spaces.

Future Outlook

After these years of observation and research, I'm full of expectations for cryptocurrency's future. When I first encountered cryptocurrency, like many people, I thought it was just a speculative bubble. But as I researched deeper, I discovered this technology is quietly changing the world.

From the initial Bitcoin, to Ethereum supporting smart contracts, to various innovative application scenarios, cryptocurrency's development speed has far exceeded many people's imagination. Decentralized finance (DeFi) allows ordinary people to participate in advanced financial services; Non-fungible tokens (NFTs) provide new possibilities for digital art and virtual assets; while continuous technological innovations make blockchain technology more accessible and applicable to daily life.

According to latest data, the global cryptocurrency market value has exceeded 2 trillion USD, with over 300 million active users. This number might seem large, but compared to global internet users, there's still huge growth potential. Especially in emerging market countries, cryptocurrency is providing new financial solutions for those who can't access traditional banking services.

However, opportunities and challenges coexist. The cryptocurrency industry still faces many issues to resolve. Such as regulatory policy uncertainty, environmental issues, security problems, etc. Especially in terms of security, as the industry develops, hacker attacks and fraud are increasing. This requires project teams and communities to work together to establish better security mechanisms.

I believe cryptocurrency's future development will continue in several directions:

First is better user experience. Current cryptocurrency products are still somewhat complex for ordinary users, requiring simpler, more intuitive interfaces and processes.

Second is more practical application scenarios. Beyond finance, cryptocurrency technology can be applied to supply chain management, digital identity verification, gaming industry, and many other fields.

Finally, a more complete ecosystem. As technology develops and applications increase, the entire cryptocurrency ecosystem will become more mature and stable.

Conclusion

Looking back at cryptocurrency's development over these years, I increasingly feel that this field's brilliance lies not just in its technological innovation, but in the possibilities it brings to ordinary people. Through continuous innovation, blockchain technology is becoming more accessible and integrated with daily life.

In this rapidly developing field, new projects appear and new technologies are developed every day. As an ordinary participant, I feel not only the convenience brought by technology but also the infinite possibilities of a whole new world.

This field is still young, still developing and improving. For friends who want to participate, my advice is: maintain curiosity but also stay vigilant; be bold to try but control risks; learn more, think more, and find suitable ways to participate.

What do you think? Welcome to share your thoughts in the comments. Next time we'll talk about how to safely participate in these projects and avoid pitfalls. After all, in this field full of opportunities, opportunities and risks often coexist.

Français

Français Deutsch

Deutsch Русский

Русский Português

Português Español

Español Italiano

Italiano Türk

Türk