Opening Chat

Dear friends, today let's discuss a particularly important topic - cryptocurrency asset security. As a veteran who has been through numerous market ups and downs in the crypto space, I have witnessed too many cases of heavy losses due to security issues. Every time I think about these incidents, it fills me with emotion.

Last year, one of my friends lost over 500,000 worth of digital assets due to insufficient security awareness when their hot wallet private key was hacked. During that period, I witnessed their entire journey from initial breakdown to self-blame, and finally having to accept reality. This incident deeply affected me and made me more profoundly aware of the importance of asset security.

To be honest, everyone starts as a beginner in the cryptocurrency field. When I first encountered Bitcoin, I was a complete novice who knew nothing about blockchain. I made many mistakes then, like storing private keys in phone memos and logging into exchanges using unsecured public WiFi - I almost lost my assets. Fortunately, I discovered and corrected these issues in time, which saved my assets.

Basic Knowledge

Before we begin, we need to understand what asset security means. Simply put, asset security is protecting your digital assets from unauthorized access, use, disclosure, or destruction. It's like a safe in your home - you need to guard against theft while also protecting against fire and water damage.

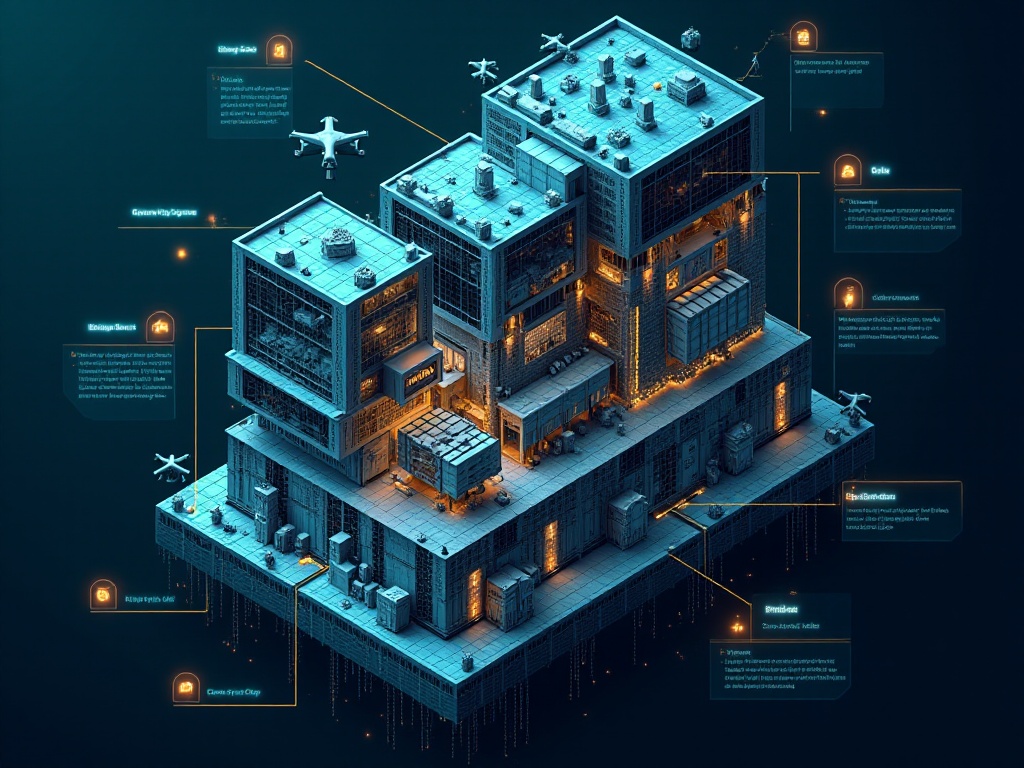

Digital asset security is actually a systematic project involving multiple levels. From basic password settings to more complex multi-signature mechanisms; from daily operational habits to emergency response plans - every link is crucial. It's like building a building where every brick matters.

When discussing cryptocurrency security, we must mention CCSS (Cryptocurrency Security Standards). This standard is like the ISO certification of the digital asset world, providing security standards for all information systems using cryptocurrencies. It specifies detailed security requirements for everything from system architecture to operational management.

Security standards aren't static; they evolve with technological developments. For example, in recent years, as quantum computing technology advances, the cryptocurrency world has begun researching quantum-resistant encryption algorithms. This shows that security is always a dynamic process requiring us to keep pace with the times.

Regarding basic security knowledge, I want to emphasize one point: never underestimate hackers' capabilities. Modern hacking techniques are becoming increasingly sophisticated, and they use various social engineering methods to obtain your information. Recently, hackers successfully stole a user's verification code by impersonating customer service, resulting in account theft.

Wallet Management

Regarding wallet management, I believe the most crucial aspect is separating cold and hot wallets. What are cold and hot wallets? Think of a hot wallet like the wallet you carry daily for regular expenses; a cold wallet is like a bank safe deposit box for storing large amounts of funds.

However, note that the concept of cold and hot wallets isn't simply about offline versus online. A true cold wallet should be in a completely offline environment, even using specialized hardware devices. I've seen people use USB drives as cold wallets, which is actually very dangerous because ordinary USB drives aren't secure enough.

Speaking of cold wallets, we must mention hardware wallets. There are many brands of hardware wallets on the market, such as Ledger and Trezor. When choosing a hardware wallet, note several points: first, always buy from official channels, don't buy second-hand to save money; second, check if the packaging is intact and shows no signs of tampering upon receipt; finally, ensure initial setup is done in a secure environment.

My personal approach is: keep only about 10% of active funds in hot wallets for daily trading. The remaining 90% of assets are stored in cold wallets, using multi-signature mechanisms. This way, even if the hot wallet has issues, losses remain controllable.

Regarding multi-signature mechanisms, I think it's worth explaining in detail. This mechanism is like a safe that requires multiple keys to open. For example, setting up a 3-5 multi-signature means you need any 3 out of 5 keys to move funds. This way, even if one private key is compromised, hackers can't transfer assets alone.

In daily use, I regularly check wallet security status. This includes reviewing recent transaction records for unusual activity; checking wallet permission settings for unauthorized application access; testing if backups are usable, etc. While these tasks are tedious, they're necessary.

Wallet management also includes proper asset allocation. My advice is don't put all your eggs in one basket. You can distribute assets across different wallets based on asset size and usage frequency. For example, you can set up a main wallet for storing large assets, several small wallets for daily transactions, and a dedicated wallet for interacting with smart contracts.

Private Key Protection

Private keys are the "master key" to your digital assets. I've seen too many people store private keys in phone memos or cloud drives, which is practically gifting hackers. Honestly, whenever I see this, I can't help but worry for them.

Private key protection is actually a science. First, the environment for generating private keys must be sufficiently secure. It's best to use offline devices, preferably brand new ones without any suspicious software installed. If possible, use dedicated hardware wallets to generate private keys.

I remember a crypto veteran sharing his private key protection plan with me: dividing the private key into three parts, storing them in three different hardware wallets, and regularly changing storage locations. Some might think this is too troublesome, but for security, this inconvenience is really nothing.

Regarding private key backup, I recommend using multiple backup methods. You can split the private key into several parts and store them differently. For example, one part can be engraved on metal plates (fireproof and waterproof), another stored on encrypted USB drives, and the remaining parts recorded using special encoding methods. This way, even if one backup is lost or damaged, overall security isn't compromised.

Private key storage location is also important. I know people who store private keys in safes, which seems secure but still carries risks. Safes can be stolen or damaged in fires or other accidents. A better approach is storing different parts of private keys in different locations, preferably different cities, reducing the risk of simultaneous loss.

Also, private key handover needs consideration. If something unexpected happens, do your family members know how to access these assets? I suggest preparing detailed instructions telling family members how to operate in emergencies. Of course, these instructions themselves must be properly secured and kept away from outsiders.

Exchange Selection

Choosing an exchange is like choosing a bank, with security being the primary consideration. So how do you judge if an exchange is secure? I've thought about this question many times and learned many lessons.

According to recent statistics, cryptocurrency exchange security incidents globally decreased by 30% in 2024 compared to 2023, but 15% of small exchanges still have major security vulnerabilities. This data tells us that while overall security is improving, risks still exist.

Regarding exchange selection, I have a profound lesson. Early on, I opened an account with a small exchange pursuing high returns. That exchange suddenly declared bankruptcy, and my assets were completely lost. Since then, I understood one principle: when choosing an exchange, it's better to accept lower returns than compromise on security.

A secure exchange should have a comprehensive risk control system. This includes cold and hot storage separation of funds, multi-signature mechanisms, regular security audits, etc. Some exchanges regularly publish their proof of reserves, which is a good transparency indicator.

Speaking of proof of reserves, I suggest learning to understand these data. For example, pay attention to the exchange's asset-liability ratio, how user funds are stored, insurance fund size, etc. These data can reflect the exchange's security status.

The exchange's technical team strength is also important. A good exchange should have a professional security team that can quickly identify and fix security vulnerabilities. I often follow major exchanges' technical blogs to see their security investments and innovations.

Besides technical aspects, exchange compliance should be considered. Global cryptocurrency regulations are becoming stricter, and choosing compliant exchanges can reduce policy risks. For example, some exchanges have obtained licenses in multiple countries, which is a good sign.

Practical Suggestions

After discussing so much theory, let's talk about practical matters. I've summarized several super practical security suggestions, all verified through experience.

For beginners, I recommend starting with small amounts. Statistics show that 90% of newcomers make basic mistakes in their first 3 months, so testing with small money is wise. That's how I started - though I lost money, it was within acceptable limits.

Developing security habits is particularly important. For example, always check if the exchange URL is correct before logging in, don't click suspicious links, regularly change passwords, etc. These seemingly simple operations can prevent many risks.

When using hardware wallets, note several details. First, always download firmware updates from official channels; second, be aware of surroundings when entering PIN codes to prevent peeping; finally, regularly test if backups are usable to avoid discovering problems when needed.

Advanced users should consider using hardware wallets. Data shows that users with hardware wallets have 80% lower asset loss rates than those using software wallets. This statistic is telling - spending a few hundred dollars on a hardware wallet is really worth it.

For large asset holders, I recommend configuring a complete security solution. This includes distributed asset storage, multi-signature mechanisms, emergency plans, etc. You can reference traditional financial institutions' practices to establish a multi-layered security protection system.

In daily operations, be especially careful to avoid high-risk behaviors. For example, don't access wallets on public computers, don't save seed phrases on connected devices, don't keep all assets on exchanges, etc. These are lessons from real cases I've witnessed.

If you notice account anomalies, take immediate action. First freeze the account to prevent further losses; then collect evidence including transaction records and logs; finally decide whether to report to police or seek legal assistance based on the situation.

Regular security checks are also important. I spend time monthly checking all accounts to confirm there are no unusual transactions or unauthorized operations. This habit has helped me detect potential security issues several times.

Concluding Thoughts

At this point, how much do you understand about cryptocurrency security? Security awareness is like a habit that needs long-term cultivation. As the ancients said, "A thousand-mile dike can be breached by an ant hole" - the same applies to asset security, where a small oversight can cause irreparable loss.

Looking back on these years, I deeply realize: in the cryptocurrency world, security always comes first. No matter how high the returns, without good security guarantees, everything could eventually turn to nothing. Like my friend's experience, one moment of carelessness can waste years of accumulation - such lessons are truly profound.

Security isn't just an individual matter but the entire community's shared responsibility. We should all actively share security experiences to help more people improve their security awareness. Only this way can the entire cryptocurrency ecosystem develop healthily.

Finally, I want to say that no security measure can replace a cautious mind. In this field, always remain vigilant and don't relax due to momentary complacency. As the saying goes, "As the way rises one foot, the devil rises ten" - as hacking techniques constantly advance, our protective awareness must also keep pace with the times.

Do you have any unique security protection experiences? Feel free to share your thoughts in the comments. Next time we'll discuss the latest Web3 security trends, remember to follow.

Français

Français Deutsch

Deutsch Русский

Русский Português

Português Español

Español Italiano

Italiano Türk

Türk